Who We Serve

Eligibility

The Georgia Tax Clinic serves all Georgians, with a primary focus on the 13 metropolitan counties of Atlanta area.

We serve the community by providing free legal services to taxpayers who would otherwise be unable to afford legal representation. The value of the services we render is represented by the amount of money we have saved our clients by helping them avoid improper adjustments to their tax returns, sorting out tax errors, and resolving outstanding tax liabilities.

Eligibility for service from the Georgia Tax Clinic is income-based. The Georgia Tax Clinic uses 250 percent of the Federal Poverty Income Guidelines as the income limit to determine client eligibility.

2024 LITC Client Poverty GuidelinesClient Demographics

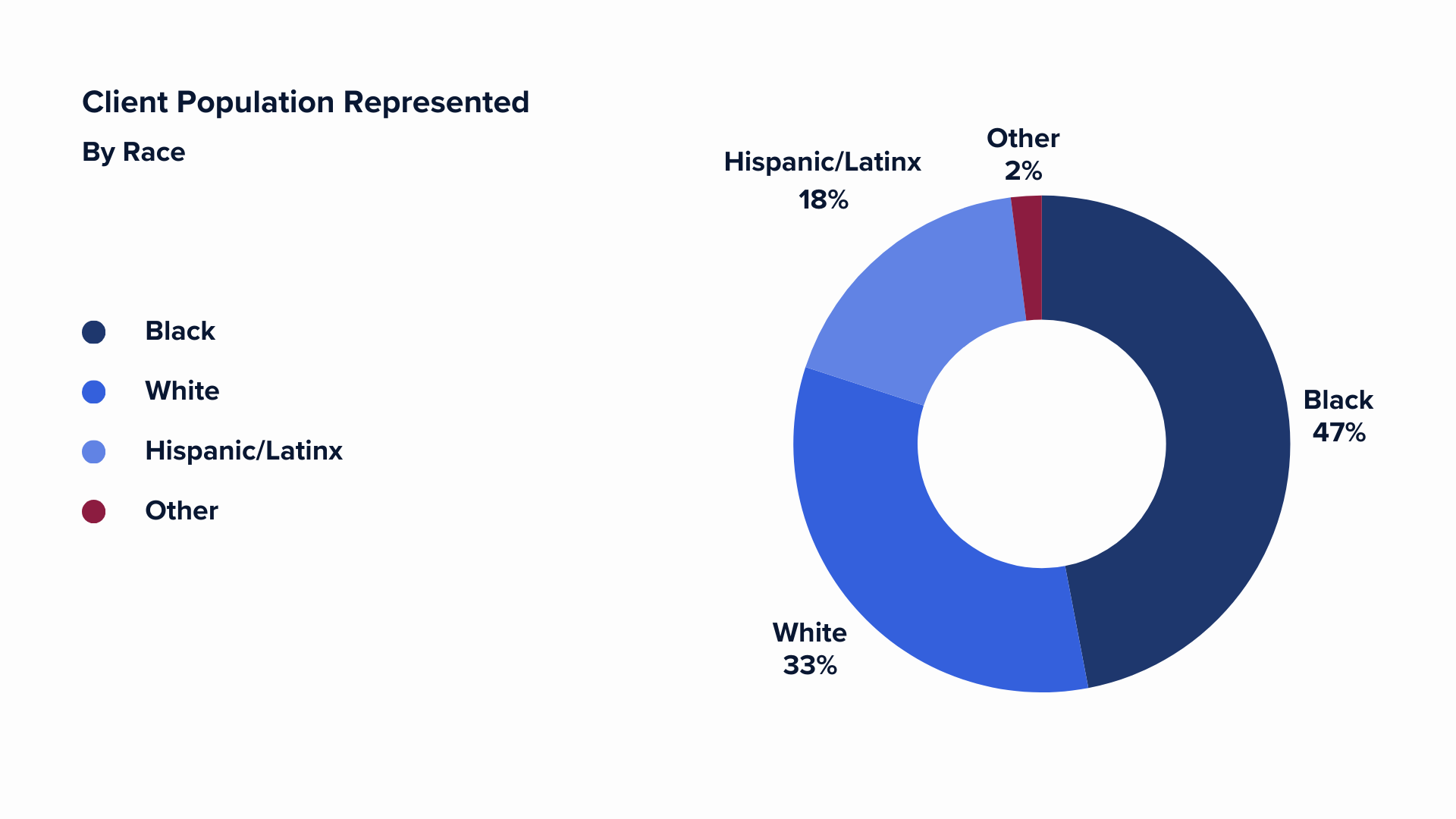

Our clients are predominately black (47%) women (59%) from metropolitan Atlanta (64%).

Services are provided to all qualifying clients regardless of race, color, religion, gender, sexual orientation, national origin, or veteran status.

Serve With Us

The Georgia Tax Clinic welcomes volunteer assistance from anyone interested in helping low-income taxpayers move towards financial stability, including law firms and lawyers, CPAs, translators, and administrative support volunteers.

Join us! Help us provide financial stability to people in need.